Digital transformation with the Eximee

low-code development platform

How does Eximee support digital transformation in banks?

The Eximee low-code platform offers the tools and resources for developing applications and modernizing legacy systems to accelerate digital transformation in banks of all types.

Accelerate digital transformation with Eximee low-code platform

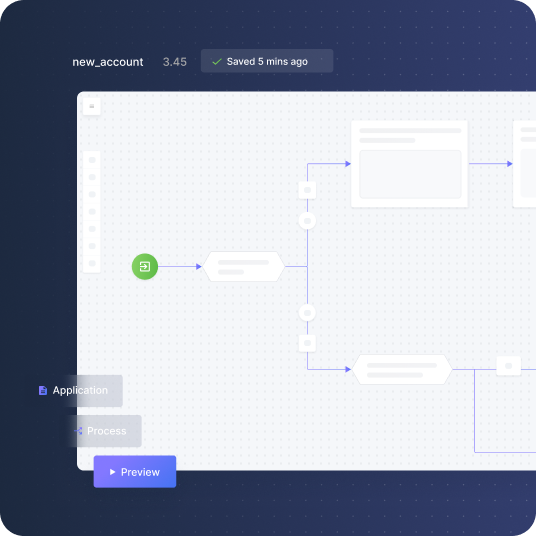

Business process mapping and automation

thanks to a visual workflow editor for designing and launching processes and seamless integrations

Omnichannel processes

thanks to easy and secure integration of existing channels, e.g., desktop, mobile, in-branch and call center applications

Developing business apps

thanks to ready-made process templates as well as graphical, business and integration components

Process monitoring

thanks to statistics and the possibility of checking the statuses of ongoing cases

Building digital forms

thanks to an intelligent form builder that enables the design of a consistent user experience regardless of a channel

Case management

thanks to an extensive and configurable application for user tasks management and execution

Future-proof digital customer experience

Flexibility and speed

Eximee low-code development platform enables the adaptation to dynamic market changes and user expectations. Reusable components and rapid development empower banks to quickly design, test, and deliver new business models and ideas.

Innovativeness

Eximee low-code streamlines digital transformation by enabling a visual approach to development and involving business analysts, researchers, trendwatchers, and other non-technical specialists in creating innovative solutions.

Legacy systems modernization

Build open and extensible applications that integrate with the existing systems and services to modernize outdated elements and transform your technological landscape incrementally.

The ready-made solution, i.e., the Eximee platform – was practically at our fingertips, and all we had to do was reach out for it. We have used Eximee to launch loan application forms integrated with e-commerce, an entirely online cash loan in mobile and desktop versions, as well as several smaller applications, such as a contact request form and an account transfer application form.

Tomasz Hajdasz

Software Development Manager, Credit Agricole

3-step implementation of the Eximee

low-code platform

How to implement Eximee in a bank?

Step 1

Discovery meeting

We discuss the current state of your processes, digitization and automation capabilities, and possible solutions.

Step 2

Analysis

Together we choose the process to digitize and develop a plan.

Step 3